Learn how to see. Realize that everything connects to everything else

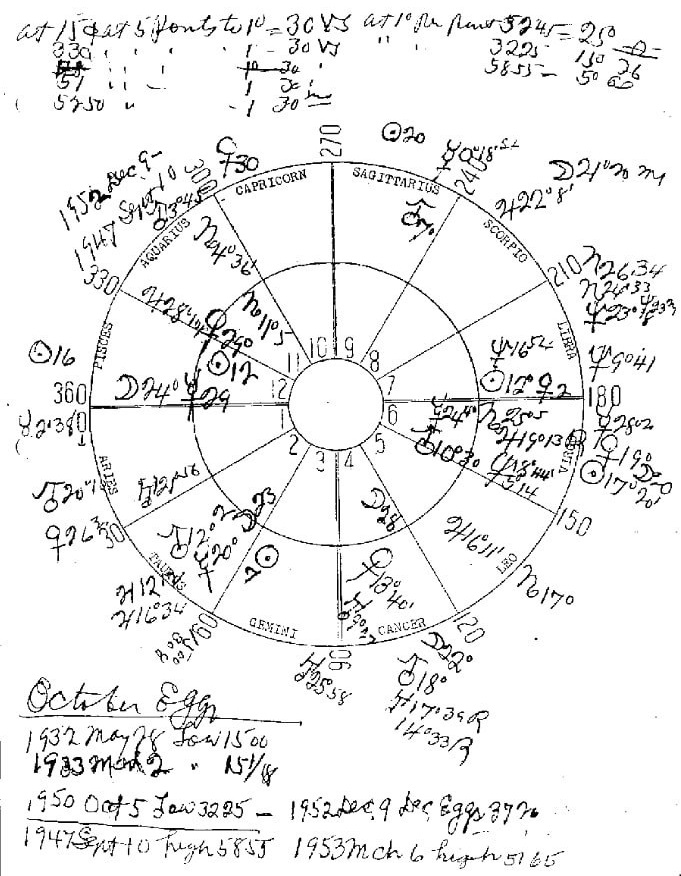

By understanding how it works, you’ll be able to see that the basic movements of the economy are predictable and can be forecast up to decades in advance. What all these methods show is that the price structure seen in the charts of stocks and commodities that were always said to be random are not at all random in the least. Mathematically precise trendlines, or square roots, or logarithms, that reverse the price patterns consistently cannot be the result of random news items or earnings releases. These patterns stretch over decades and beyond and we are faced with the inescapable conclusion that the emotional buying and selling behavior of man is a mathematically determined outcome. This of course implies that man’s free will may not be so free as he thinks. Better yet, he may not be thinking at all!

Are not two sparrows sold for a penny? Yet not one of them will fall to the ground apart from the will of your Father. And even the very hairs of your head are all numbered.

Matthew 10:29

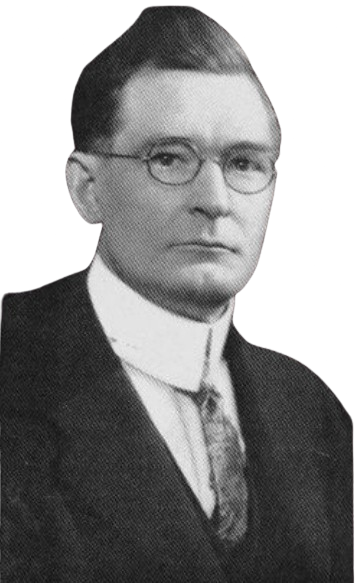

William Delbert Gann

W.D Gann has been a leading influence in the field of Technical Analysis, and his groundbreaking work in the study of Time analysis is unlikely to be surpassed. Gann was born on 6th June 1878 in Lufkin, Texas, into a poor family of 8 children. His father was a cattle/ Cotton trader, and his mother taught Gann to read using the Bible, which was to become a major influence on the way Gann studied market movements.

In 1908, Gann made his great discovery of a Time Factor, and proved his discovery by trading his accounts with unheard of returns, turning $300 into $25000 within 3 months. This Level of return created a huge interest in the techniques that Gann was using, and at the beginning of his Commodities course is a reproduction of an article written in the Ticker and Investment Digest of December 1909. In this article an import inspector William Gilley wrote:

“Mr Gann’s Calculations are based on Natural Law. I have followed his work closely for years. I know he has a firm grip of the basic principles which govern stock market movements, and I do not believe any other man on earth can duplicate his idea or his method at the present time.”

“Gann has taken $130, and in less than one month, run it up to over $12000. He can compound money faster than any man I have met.”

During the Month of October 1909, in 25 market days, Mr Gann made 286 trades in various stocks, both Long and Short trades. Of these Trades, 286 were profitable and 22 were losses. The capital with which he operated was doubled ten times, so that at the end of the month he had one thousand Percent of his original margin.

Swing Trading

Master long-term swing trading using planetary cycles and Gann’s core principles.

Includes 5 Gann Astro swing methods and 2 proprietary software tools for timing market reversals accurately.

Intraday Trading

- Master precise intraday trading using fast-moving Ascendant equations and planetary timing.

- Includes 6 Gann Astro intraday methods and 3 proprietary software tools for real-time market prediction and execution.