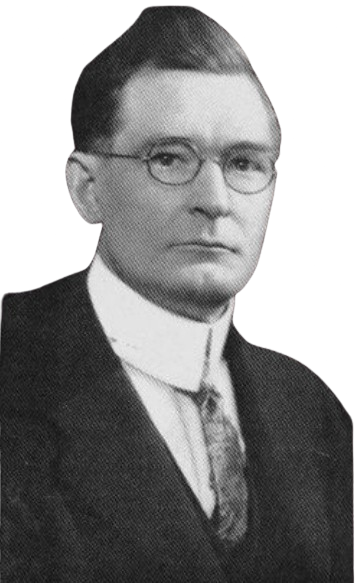

W.D Gann has been a leading influence in the field of Technical Analysis, and his groundbreaking work in the study of Time analysis is unlikely to be surpassed.

Gann was born on 6th June 1878 in Lufkin, Texas, into a poor family of 8 children. His father was a cattle/ Cotton trader, and his mother taught Gann to read using the Bible, which was to become a major influence on the way Gann studied market movements.

In 1894, Gann left school and became a newspaper seller on a train. He also worked in a cotton warehouse until he left to work in New York. He started trading in cotton and made huge profits after predicting the decline and panic in stocks and commodities.

Gann later worked as a broker, and in doing so was able to identify patterns of error by the general public.

In 1908, Gann made his great discovery of a Time Factor, and proved his discovery by trading his accounts with unheard of returns, turning $300 into $25000 within 3 months.

This Level of return created a huge interest in the techniques that Gann was using, and in the beginning of his Commodities course is a reproduction of an article written in the Ticker and Investment Digest of December 1909. In this article, an import inspecto,r William Gilley wrote:

“Mr Gann’s Calculations are based on Natural Law. I have followed his work closely for years. I know he has a firm grip of the basic principles which govern stock market movements, and I do not believe any other man on earth can duplicate his idea or his method at the present time.”

“Gann has taken $130, and in less than one month, run it up to over $12000. He can compound money faster than any man I have met.”

“During the Month of October 1909, in 25 market days, Mr Gann made 286 trades in various stocks, both Long and Short trades. Of these Trades, 286 were profitable and 22 were losses. The capital with which he operated was doubled ten times, so that at the end of the month he had one thousand Percent of his original margin.”

In 1910, Gann wrote his First Book and later produced several newsletters.

The New York Times newspaper acknowledged Gann as predicting the end of World War 1 after earlier in 1914 predicting its start.

1923, Gann wrote The Truth of the Stock Tape, one of his best books and still very popular with students of trading today.

In 1927, Gann wrote Tunnel through the Air, a fictional novel in which he predicted the beginning of World War 2, particularly emphasising the attack by Japan on the United States. This novel has been the subject of debate as it purports to have a “Veiled in Secret Code” interwoven in the storyline. Remember that the Beginning of World War 2 was some 10 years in the future from when the book was originally published.

In 1928, Gann wrote of the Great Depression to follow, and predicted the start of the greatest Stock market crash in history.

Over the Next few years, Gann would write several more books, The New Stock Trend Detector, How to Make Profits Trading in Puts and Calls. Face Facts America, How to make Profits in Commodities, 45 Years in Wall Street, and his final boo,k The Magic Word.

In 1951, with his friend Ed Lambert, Gann established the Lambert Gann Publishing Company.

In 1955, after returning from one of his many trips to Cuba, Gann died from Stomach Cancer (but there is also foul play involved, that he was poisoned and killed).

His Many discoveries in the stock market can help every trader to make profits, but of course, one of Gann’s main ideas was that each individual must make the effort to work hard and study. His many writings never clearly outlined his time factor or how he was able to so accurately predict turning points in a market.

This has led to many interpretations of his cycle analysis, and of course, these interpretations can be quite varied and different. Many students or traders have attempted to emulate the success of this great trader and failed. The obvious and easy course of action, then, is to deride the instructional work and cast doubt on the accuracy of the legend. I have personally heard many, even leading traders, denounce Gann’s work and teachings as rubbish, and this should be interpreted as a failing of the student rather than a failing of the technique.

Unfortunately, the reports of Gann’s immense wealth cannot be verified. It is known that he was the first private landlord owner of a metal aircraft, and he owned a large boat that he purchased from a single trade. He is also reputed to have $50 million fortune. So despite the doubters’ non-believers detractors, one thing is certain, 79 years after the man’s death, he is still considered the leading Analyst of all time, and still widely regarded by those who have understood the message left behind.

Gann did not invent the Square of 9, he found it inscribed in the pyramids in Egypt and in some temples in India. He did work heavily with the Square of 9 and was the first analyst/trader to recognise its use and value. He made the Square of 9 an integral part of his mechanical trading system. It is this part of his trading methodology that we are going to explore in this course.

0 Comments